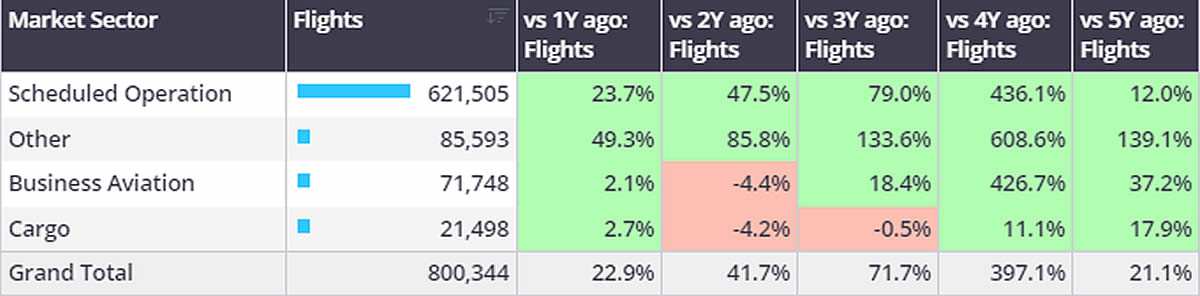

At the start of April (1st Ц 7th), global bizjet sectors are 2% ahead of comparable last year, trailing 2022 by 4%, 37% ahead of 5 years ago. Over the same period, scheduled airline activity is 24% ahead year-on-year, 12% ahead of 2019. Dedicated cargo sectors start this month are 3% ahead of last year, 18% ahead of 2019.

Chart 1: 1st – 7th April 2024 activity by sector, compared to previous years.†(Business aviation = business jets only)

United States

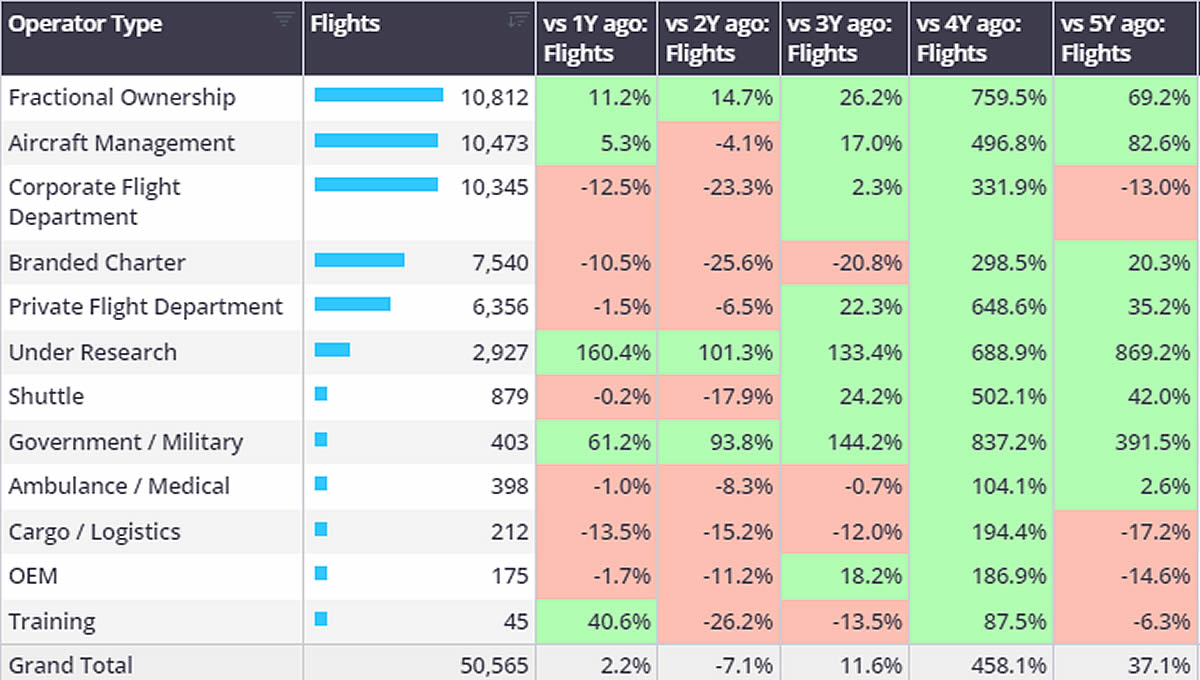

In Week 14, 50,565 business jet sectors were flown in the United States, 10% more than the previous week, 9% more than Week 14 in 2023. So far this year, US bizjet activity is on par with last year, 4% below the highs of 2022, 29% ahead of 2019. Top 3 Busiest States Florida, Texas and California are seeing year-on-year growth.

At the start of this month, US bizjet activity is 2% ahead of the same 7 days in April 2023, trailing April 2022 by 7% and 37% ahead of April 2019. Fractional fleets continue to run hot, starting April ahead of any other April in the last 5 years. In contrast, Corporate Flight Departments are flying 13% fewer sectors at the start of April this year compared to 5 years ago. Branded Charter sectors are also seeing a drop in activity at the start of the month, although still 20% ahead of 2019. Across the US Florida saw roughly 8,500 bizjet departures in the opening 7 days of April, 5% more than last year. Georgia and South Carolina seeing large YOY declines at the start of the month. The Augusta Masters Golf tournament begins this week (April 11th), at the 2023 tournament airports nearby (KAGS, KAIK, KBNL) saw average daily arrivals 1 day before and during the event 3 times higher than the average for the month of April.

Chart 2: US Bizjet Operator Types, 1st Ц 7th April 2024 vs previous years.

Europe

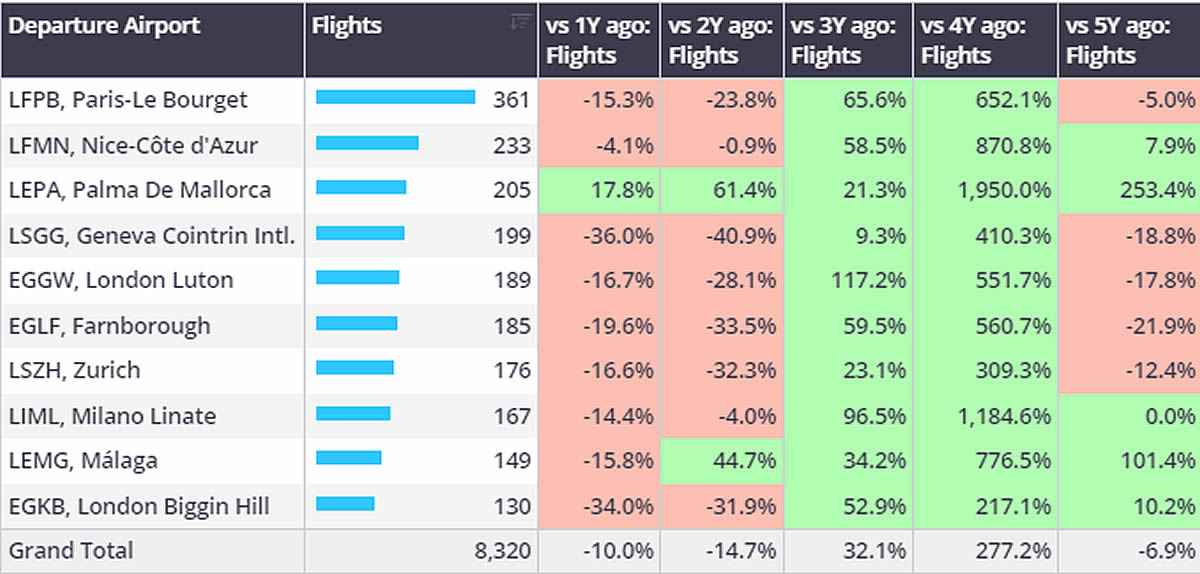

In Week 14, European business jet activity was 2% below Week 14 2023, 1% ahead the previous week. Year to date, European bizjet activity has fallen 3% compared to last year, 12% below 2022, however 1% ahead of comparable 2019.

In Europe, bizjet activity at the start of April is 10% below comparable last year, 15% below 2022, 7% below 2019. The busiest markets are seeing bizjet sectors decline compared to 2019, Spain and Italy remain notable exceptions, Spain seeing the busiest start to April in the last 5 years, Italy 6% behind 2023, but well ahead of previous years.

In Spain, several leisure spots appear to be driving growth at the start of this month. Palma De Mallorca, Madrid-Barajas and Barcelona airports seeing 18%, 28% and 40% YOY growth. The domestic bizjet market in Spain is robust, accounting for almost a third of bizjet flights this month. Busiest international connection is with Germany, sectors up 44% YOY.

Chart 3: Top European bizjet airport countries, 1st Ц 7th April 2024 vs previous years.

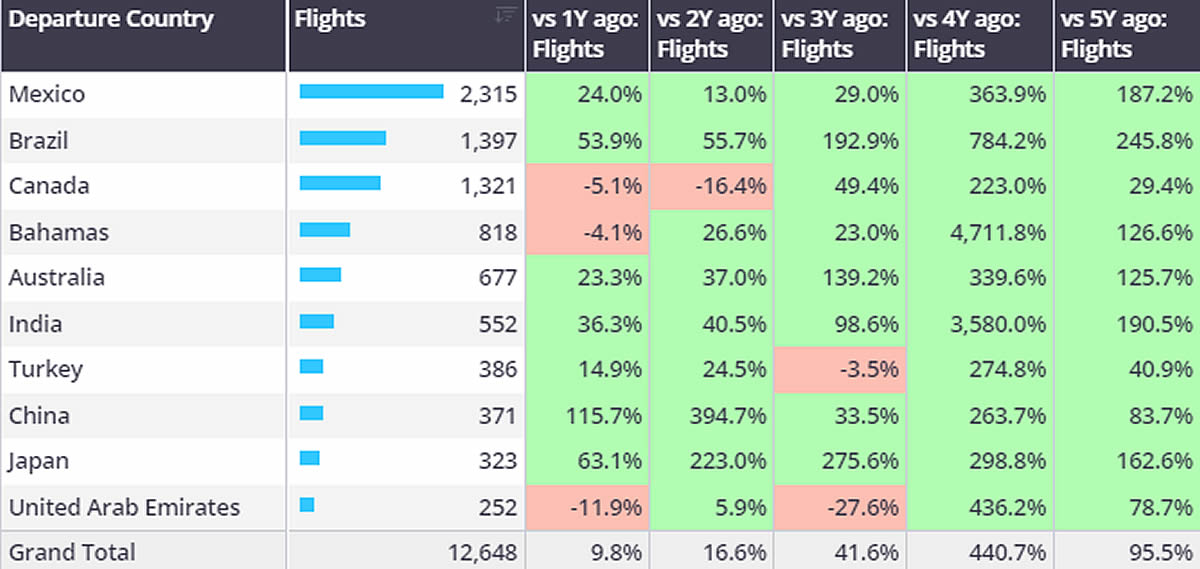

Rest of World

In Week 14, bizjet activity in the Middle East fell 7% compared to the previous week, falling 15% behind Week 14 in 2023. Canada, Bahamas and United Arab Emirates are 3 notable markets outside of the US and Europe to see YOY declines at the start of this month. Elsewhere China seeing a much-improved start to April compared to previous years.

Chart 4: Busiest bizjet countries outside of US and Europe, 1st Ц 7th April 2024 vs previous years.